Disconnect between Hong Kong stock performance and politics

This Post has Comments Off on Disconnect between Hong Kong stock performance and politics

The current stirring of political passions in Hong Kong has yet to truly shake the city’s stock market, even with protesters poised to “occupy” and effectively close down Central – the main financial district. One reason is likely the “mainlandization” of the benchmark Hang Seng Index.

Uncertainty over the Chinese economy kept Hong Kong-listed shares lagging behind those of other markets early in the year. But on July 2, the day after the 17th anniversary of the British handover of Hong Kong to China was marked with a massive pro-democracy demonstration, the index finally surpassed the level seen in January.

The Hang Seng continued its upward march and set a six-year high on Sept. 3. Since then, selling has picked up, but most experts again attribute this to concerns about China’s economy — not local politics.

The Occupy Central movement demands that Hong Kongers be granted true universal suffrage. Beijing wants a system in which only a few cherry-picked, pro-mainland candidates can run for Hong Kong’s top office. In protest, the movement plans to camp out in the city’s Central district, a move that could disrupt the financial institutions based there. Even so, while companies have been making contingency plans, there seems to be little sense of urgency.

“Hong Kong people are realistic,” said Y.K. Chan, a fund manager at Phillip Capital Management (HK). This, he explained, has led many to the conclusion that Hong Kong will get nowhere by making the Chinese Communist Party an enemy. Chan said a prolonged protest could result in downgrades but expressed doubt that the movement can mobilize huge numbers of people for the long haul.

“There may be a psychological influence on the stock market but it would be limited,” said Jaseper Tsang, director of research at CSC Securities (HK). “There is no Gandhi in Hong Kong,” Tsang added.

Many experts do believe a drawn-out protest would have at least some adverse effects on the economy. “A prolonged period of political discord in Hong Kong … would be credit negative,” said Steven Hess, senior vice president of Moody’s Investors Service. Still, at least when it comes to the stock market, the connection between local politics and prices is not that strong.

Where the chips fall

The Hang Seng started out in 1969 as an index mainly made up of Hong Kong companies. Over the years, as mainland businesses sought to raise funds and the bourse looked to add growth stocks, the ratio of mainland-tied issues increased.

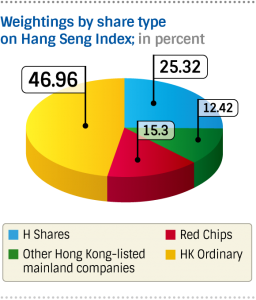

Companies listed on the Hong Kong stock exchange are divided into four groups:

HK Ordinary, for local shares;

Red Chips, for the Hong Kong units of companies based on the mainland;

H Shares, for companies incorporated on the mainland;and

Other, Hong Kong-listed mainland companies.

Today, of the index’s 50 components, 12 are Red Chips and 9 are H Shares. There are also 6 designated as other mainland companies, including Internet empire Tencent Holdings. In essence, mainland-based businesses account for 53% of the Hang Seng, making it more of a Chinese benchmark than a Hong Kong-specific one.

The presence of mainland Chinese companies has made the Hong Kong exchange an attractive option for overseas investors, whose access to actual mainland shares is severely restricted. It also explains why the Hong Kong market looks surprisingly stable despite the brewing unrest.

Source Nikkei Asia Review